Payment trends in 2025

The global payments landscape is experiencing unprecedented transformation in 2025, fueled by rapid digital growth and the way new technology is reshaping what customers expect. As this digital shift accelerates, the pressure is on payment providers and financial institutions to keep up with the trends that will define who stays competitive.

Market Growth and Economic Impact

Market Growth and Economic Impact

The global payments market is projected to reach $788.06 billion in 2025, representing growth from $724.52 billion in 2024, with a compound annual growth rate of 8.8% expected through 2029. This surge traces back to the pandemic’s push toward digital and the lasting move away from cash.

Digital wallet transaction volumes are forecasted to reach an astounding $17 trillion globally by 2029, up 73% from 2024 levels. In Egypt, the payments market stands at $20.6 billion in 2024 and is forecast to reach $31 billion by 2028, advancing at an 11% CAGR (compound annual growth rate).

Digital Wallet Revolution and Consumer Adoption

Digital wallets are leading the charge in payment innovation, in Egypt, digital payment use is climbing fast — nearly half of the population now reports comfort transacting online. This represents a significant shift in consumer behavior, with over 70% of global consumers now using digital payment methods, moving away from traditional cash transactions.

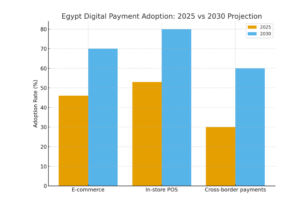

The adoption rates vary significantly across different use cases:

| Payment Channel | Egypt’s Adoption 2025 |

2030 Projection |

| E-commerce | ~46% | 13–15% CAGR |

| In-store POS | ~53% | ~75–85% |

| Cross-border payments | Growing |

>60% |

In Egypt, nearly 46% of internet users shop online weekly, while around 53% of SMEs have adopted digital payments. Cross-border flows remain central, with remittances exceeding $30 billion annually and steadily shifting toward digital channels.

Emerging Payment Technologies

Biometric Authentication

Biometric payments are moving into the mainstream, with everything from fingerprints to facial and voice recognition tightening security. Early results suggest these tools can cut fraud by as much as 75% while making the checkout experience faster and easier.

Artificial Intelligence and Machine Learning

AI-powered payment systems are revolutionizing fraud detection and transaction processing. Advanced AI systems are achieving 30% reductions in fraud while improving transaction approval rates through intelligent routing and risk assessment

Central Bank Digital Currencies (CBDCs)

Central banks worldwide are advancing CBDC initiatives, with government-backed digital assets designed to improve financial inclusion and reduce cross-border transaction inefficiencies. These developments aim to provide faster cross-border payments and reduced reliance on traditional intermediaries

Blockchain and Tokenization

The tokenization market is experiencing explosive growth, projected to reach $4.13 billion in 2025 with a CAGR (compound annual growth rate) of 22.1%.

Blockchain is gaining ground in B2B and commercial payments, where it’s being used to move money faster and with greater security.

Regulatory Landscape and Compliance Challenges

The payments industry faces significant regulatory changes in 2025, with major compliance deadlines reshaping operational requirements:

| Regulation | Deadline |

Impact |

|

SEPA Instant Payments |

January 2025 | Payment Service Providers must support instant payments |

| Fedwire ISO 20022 Migration | July 2025 | New message format implementation |

| PSD2, AML, KYC Directives | Ongoing | Enhanced authentication and data privacy |

| Egypt Instant Payment Network (IPN) Regulations | Egypt Instant Payment Network (IPN) Regulations | Egypt Instant Payment Network (IPN) Regulations |

Over 98% of financial institutions report rising compliance costs due to complex global regulations, creating pressure for infrastructure modernization. The regulatory timeline shifts highlight the challenges banks face in implementing complex technical changes within tight deadlines.

Regional Trends and Cross-Border Payments

Egypt’s Digital Surge

In Egypt, mobile wallet transactions in Q2 2025 topped USD 19.63 billion, up from USD 11.41 billion in the same period the year before — a massive 72% year-over-year increase.

Meanwhile, about 64% of Egyptians reported higher use of digital payments in 2024, and 35% had adopted wallets.

The Rise of Embedded Finance

Embedded finance is transforming how payments are integrated into business operations, with experts anticipating $6.5 trillion in payments processed through embedded channels by 2025. This trend represents a shift from standalone payment solutions to integrated financial services within business ecosystems.

Future Outlook and Strategic Implications

The payments industry in 2025 is characterized by rapid technological advancement, regulatory complexity, and evolving consumer expectations. Key strategic priorities for industry stakeholders include:

- Digital Wallet Integration: Essential for competitive positioning

- Security Investment: Biometric and AI-powered solutions

- Regulatory Compliance: Proactive preparation for changing requirements

- Consumer-Centric Design: Focus on convenience, rewards, and seamless experiences

- Partnership Strategy: Collaboration with technology leaders and fintech innovators

Security Innovations and Fraud Prevention

Payment fraud losses have surpassed $40 billion globally, making security innovations critical for industry sustainability. Key security developments include:

- Biometric Authentication: Up to 75% fraud reduction capability

- AI-Powered Fraud Detection: Real-time risk assessment and prevention

- Tokenization: Enhanced data protection and privacy compliance

- Advanced Encryption: Multi-layer security protocols

In conclusion,

The payment trends of 2025 reflect a fundamental transformation of the financial services landscape. Digital wallets, emerging technologies, and changing consumer behaviors are reshaping how transactions are conducted globally. Organizations that embrace these trends, invest in security innovations, and maintain regulatory compliance will be best positioned to thrive in this dynamic environment.

As we move toward an increasingly digital future, the payments industry must balance innovation with security, convenience with compliance, and global reach with local requirements. The successful navigation of these trends will determine the leaders in tomorrow’s financial ecosystem.

Sources

- Google Trends data (digital wallet searches)

- Visa consumer & industry reports (digital wallets, biometrics, authentication trends)

- Discover Global Network research (payments) consumer biometrics, fraud prevention, real-time

- Nexi Group mobile payment reports (Italy, Nordics, sustainability)

- Worldpay forecasts (global real-time transactions, green payments)

- J.P. Morgan payment insights (cross-border flows, Wire 365, $10T daily processing)

- LexisNexis fraud prevention and embedded payments studies

- FedNow and RTP Network (instant payments adoption, ISO 20022)

- Central Bank of Egypt (IPN/Instapay regulations, adoption)

- Mordor Intelligence (Egypt digital payments & e-commerce forecasts)

- PwC / Egyptian consumer surveys (digital payment adoption rates)

- Thunes & Arab News (Egypt remittances)

1 Comment

Mollyt

I really liked your site.