RegTech: How It Works and Why It Matters

Technology is changing finance faster than traditional regulation can keep up. RegTech (Regulatory Technology) fill this gap by using AI, and automation to improve compliance and oversight. Instead of simply being buzzwords, they have become the backbone of a smarter regulatory landscape.

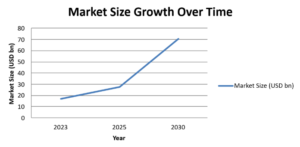

Global Growth of RegTech

The global RegTech market was valued at USD 12.4 billion in 2023 and is expected to reach USD 41 billion by 2030, growing at an annual rate of around 23%. Adoption has spread rapidly: over seventy percent of financial institutions in the European Union and the United States now rely on RegTech tools for anti-money laundering (AML) and know-your-customer (KYC) compliance. On the supervisory side, more than thirty-five regulators worldwide, including the Monetary Authority of Singapore, the European Central Bank, and the UK’s Financial Conduct Authority, use AI-driven monitoring platforms to keep markets in check.

| Year | RegTech Market Size (USD bn) |

CAGR |

|

2023 |

17.02 | – |

| 2025 | ≈25-30 (est.) | 23.1% |

| 2030 | 70.64 |

23.1% |

Egypt’s Regulatory Context

Egypt is gradually weaving RegTech into its financial framework. The Central Bank of Egypt (CBE) issued the 2019 Banking Law and later its 2020 FinTech Strategy, which encourage electronic KYC (e-KYC) and digital payment adoption. The Financial Regulatory Authority (FRA) has also started using supervisory technologies to enhance market surveillance and anti-money laundering compliance monitoring. Egypt is aligning itself with the global standards set by the Financial Action Task Force (FATF), which requires robust AML and counter-terrorism financing controls. A clear example of RegTech in action came in 2021, when the CBE mandated the use of e-signatures and digital onboarding in banks, a move that reduced fraud and minimized manual errors in customer verification.

How RegTech Works

In practice, RegTech operates by collecting data through APIs that pull customer and transaction information from multiple systems. Artificial intelligence then evaluates this data, checking it against blacklists and regulatory requirements, and automatically flagging suspicious patterns. Instead of lengthy manual reviews, institutions can now generate machine-readable reports that are instantly transmitted to regulators. The process creates a continuous audit trail, strengthening both transparency and efficiency.

International Regulations and Adoption

Globally, regulators are formalizing the shift. In the European Union, the European Commission introduced the PSD2 (Payment Services Directive), which forces banks to adopt APIs and lays the groundwork for RegTech in open banking and anti-money laundering (AML) compliance. In the United States, the Securities and Exchange Commission (SEC), the body that regulates securities markets, and the Financial Crimes Enforcement Network (FinCEN), which enforces anti-money laundering laws, both require automated reporting for securities transactions and suspicious activities. In Singapore, the Monetary Authority of Singapore (MAS); the country’s central bank and integrated financial regulator; launched a SupTech platform in 2019 designed around AI-driven monitoring. Meanwhile, in the Gulf, the Central Bank of the United Arab Emirates and the Saudi Central Bank (SAMA) mandate electronic KYC for fintechs, aligning their regulatory ecosystems with international standards and strengthening digital financial security.

| Region | Regulation | Focus Area |

Impact |

|

EU |

PSD2 | Open banking, APIs | Boosted RegTech KYC/AML |

| USA | FinCEN & SEC | AML, securities | Automated suspicious activity reports |

| Singapore | MAS SupTech | Market supervision | AI-driven monitoring |

| Egypt | CBE Banking Law 2019 | e-KYC, digital payments |

Supports fintech innovation |

Risks and Challenges

For all it’s impact, RegTech is not flawless. It’s effectiveness relies heavily on the quality of input data, and poor practices can lead to blind spots. AI models raise transparency issues, as their inner workings are not always explainable, which risks embedding bias into regulatory decisions. There are also ethical concerns about automation reducing human roles in compliance and oversight. Building trust in Regtech requires cooperation between regulators, institutions, and technology providers.

Future Outlook

Looking forward, emerging technologies such as blockchain promise immutable audit trails, while regulators experiment with dynamic, machine-readable reporting frameworks that replace static PDF filings. In the near future, AI systems may not only detect risks but actively prevent them by triggering safeguards before issues escalate. The trajectory is clear: as finance continues its digital transformation, RegTech will not remain optional. They are set to become the essential pillars of a more agile and resilient financial system.

Sources

Grand View Research. Regulatory Technology Market Size, Share & Trends Analysis Report, 2024–2030. (USD 17.02 bn in 2023; USD 70.64 bn by 2030; CAGR 23.1%).

Zion Market Research. Global RegTech Market Report 2023–2032. (USD 9.24 bn in 2023; USD 50.64 bn by 2032; CAGR 20.8%).

MarketsandMarkets. RegTech Market by Component, Deployment Type, Organization Size, Application, and Region – Global Forecast to 2026. (USD 7.6 bn in 2021; USD 19.5 bn by 2026; CAGR 20.8%).

Central Bank of Egypt (CBE). Law No. 194 of 2020 on the Central Bank and the Banking Sector.

Central Bank of Egypt. FinTech & Innovation Strategy 2020.

Financial Regulatory Authority (FRA), Egypt. Market Surveillance and AML Guidelines.

Financial Action Task Force (FATF). International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation (FATF Recommendations).

Deloitte. The RegTech Universe 2023. Explains AI-driven compliance, KYC/AML automation, and regulatory reporting.

World Bank. RegTech for Regulators: Innovations for Better Compliance.

European Commission. Directive (EU) 2015/2366 on Payment Services (PSD2).

U.S. Securities and Exchange Commission (SEC). Automated Reporting and Market Oversight Guidelines.

Financial Crimes Enforcement Network (FinCEN). AML Program and Suspicious Activity Reporting Rules.

Monetary Authority of Singapore (MAS). SupTech Initiatives and AI in Supervision (2019).

Central Bank of the UAE. Regulatory Framework for Stored Values and Electronic Payment Systems (2017, updated 2021).

Saudi Central Bank (SAMA). Electronic Know Your Customer (e-KYC) Regulations for Financial Institutions (2020).

Bank for International Settlements (BIS). SupTech and RegTech: Tools for Better Oversight (2021).

Financial Stability Board (FSB). Artificial Intelligence and Machine Learning in Financial Services (2017).

European Central Bank (ECB). SupTech Applications for Market Supervision.

World Economic Forum. The Future of RegTech: Blockchain and Real-Time Compliance (2022).