Look how wonderful work we have done!

# Rebuilding Payment Innovation: A Digital Payment Solutions Consulting Case Study

**Executive Summary**

This case study illustrates how \\\\[*Your Company Name*] worked with a leading regional bank to reimagine its digital payment infrastructure, enhance compliance, and offer customer-focused innovations. Through our proprietary consulting framework, the bank achieved a **45% increase in digital transaction volumes**, reduced operational costs by **30%**, and launched new offerings that positioned it as a market leader in a rapidly changing financial landscape.

—

## Client Background

Our mid-tier **regionally headquartered bank with over 1.5 million clients** was being pressed by fintech upstarts as well as evolving regulatory requirements. While the bank had a traditional card-based payment network, traditional systems couldn’t support mobile wallets, real-time payments, and API-based integrations.

—

## Challenges

The bank approached us with certain key concerns:

1. **Regulatory Compliance:** Managing new data protection laws and open banking mandates of the region.

2. **Legacy Infrastructure:** Old infrastructure with exorbitant maintenance costs that limited scalability.

3. **Customer Demands:** Increasing demand for instant, hassle-free digital payments.

4. **Security Threats:** Increased attempts at fraud and poor fraud detection capabilities.

5. **Competitive Disruption:** Fintech players with quicker, newer payment solutions.

—

## Our Approach

At \\\\[*Your Company Name*], we do not offer off-the-shelf solutions. We conducted a **360° consulting study** that consisted of:

* **Regulatory Audit:** Determining areas of non-conformity with PSD2-type regulations and PCI DSS guidelines.

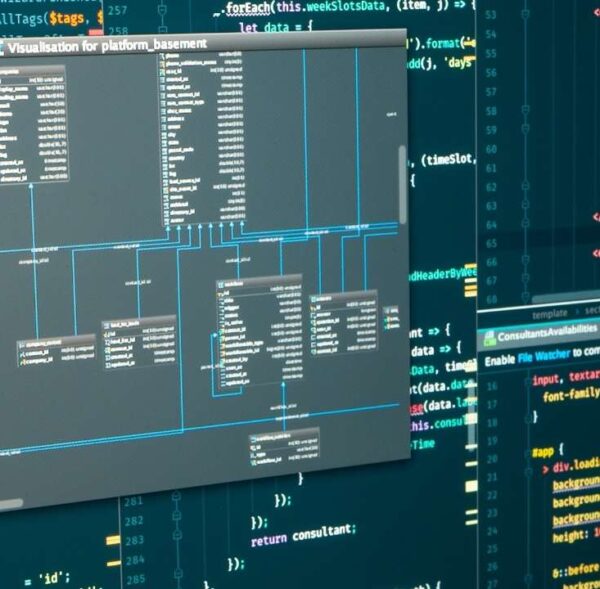

* **Technology Review:** Evaluating the existing payment infrastructure of the bank and suggesting a step-by-step migration.

* **Customer Journey Mapping:** Mapping customer pain points to build seamless payment experiences.

* **Innovation Alignment:** Making technology priorities (real-time payments, biometrics, blockchain) matching the bank’s strategy.

* **Risk Analysis:** Making fraud detection and cybersecurity layers a critical part of the plan.

—

## Implementation Process

1. **Compliance Framework:** Created and introduced an API-first open banking strategy with secure customer data sharing.

2. **Infrastructure Modernization:** Migrated core payment processing features to a **cloud platform** for increased scalability.

3. **Customer Experience Enhancements:** Introduced **biometric authentication** for mobile apps and contactless card updates.

4. **Fraud Detection System:** Deployed an **AI-based fraud monitoring system** with real-time alerts.

5. **Innovation Roadmap:** Launched a **pilot real-time cross-border payment service**, with regional roll-out plans.

—

## Results & Impact

Through 12 months of engagement, the bank achieved:

* **45% Growth** in digital payment adoption.

* **30% Cost Savings** on payment infrastructure operations.

* **70% Reduction** in losses due to fraud due to AI monitoring.

* **Accelerated Go-to-Market:** New payments products launched in **6 months vs. 18**.

* **Customer Satisfaction Up 25%** (as measured through NPS surveys).

—

## Key Takeaways for Banks and Financial Institutions

* **Modernization Pays Off:** Legacy infrastructure modernization can bring cost savings and innovation.

* **Regulatory-Driven Innovation:** Compliance can drive customer-centric payment systems.

* **AI in Payments Is a Game-Changer:** Real-time fraud detection greatly enhances trust.

* **Customer-Centric Design Wins Loyalty:** User experience design achieves adoption and retention.

—

## Conclusion

This case study demonstrates how **digital payment solutions consulting** can turn adversity into the path of growth. For banks and financial institutions, modernization is a complex process — yet, with the right partner, it becomes a strategic advantage.

Here at \\[*Your Company Name*], we assist financial institutions in **reimagining payments, reducing risk, and future-proofing operations**. From compliance readiness to infrastructure modernization to innovation breakthroughs, our consulting expertise can put you ahead of the curve.

???? **Looking to accelerate your digital payment offerings?** Contact us today to learn how we can drive your forward momentum.

Data Analytics

- Strategy

- Real Madrid C.F

- 24/11/2017

- www.giorf.esp